Student loan consolidation sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. It delves into the intricacies of consolidating student loans, shedding light on the advantages, eligibility criteria, consolidation options, and the application process.

What is Student Loan Consolidation?

Student loan consolidation is the process of combining multiple student loans into a single loan with one monthly payment. This is usually done through a direct consolidation loan provided by the Department of Education.

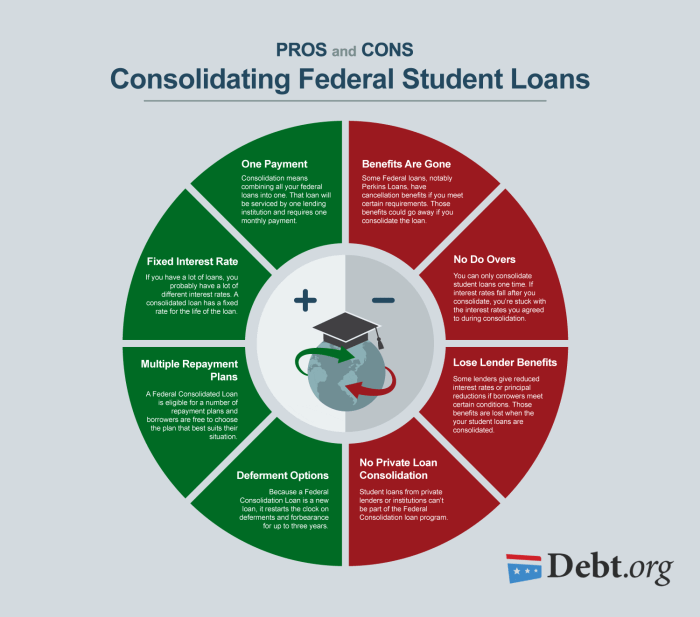

The purpose of consolidating student loans is to simplify repayment by combining multiple loans into one, potentially lowering monthly payments, and extending the repayment period. It can also help borrowers manage their debt more effectively by offering different repayment plans and potentially reducing the overall interest rate.

How Student Loan Consolidation Works

When a borrower applies for a direct consolidation loan, the Department of Education pays off the outstanding balances on the individual loans. This results in a new loan with a fixed interest rate based on the weighted average of the interest rates of the loans being consolidated. The borrower then makes a single monthly payment to the Department of Education.

- Consolidation can extend the repayment period, resulting in lower monthly payments but potentially higher overall interest paid.

- Borrowers can choose from various repayment plans, such as income-driven repayment options, to better suit their financial situation.

- Private student loans are not eligible for federal consolidation but can be consolidated through private lenders.

Benefits of Student Loan Consolidation

When it comes to managing student loan debt, consolidation can offer several advantages that can make the repayment process more manageable and cost-effective.

Consolidating student loans can simplify the repayment process by combining multiple loans into a single loan with one monthly payment. This can help borrowers keep track of their payments more easily and avoid missing any deadlines.

Lower Interest Rates

One of the key benefits of student loan consolidation is the potential to lower interest rates. When borrowers consolidate their loans, they may qualify for a lower interest rate, especially if they have improved their credit score since initially taking out the loans. This can result in significant savings over the life of the loan.

Extended Repayment Terms

Consolidation can also offer the option to extend the repayment terms of the loan. While this may result in paying more interest over time, it can help lower the monthly payments and provide more flexibility for borrowers who may be struggling to make ends meet.

Fixed Interest Rates

Another advantage of student loan consolidation is the opportunity to switch from variable interest rates to a fixed interest rate. This can provide borrowers with more stability and predictability in their monthly payments, making it easier to budget and plan for the future.

Streamlined Loan Management

By consolidating student loans, borrowers can streamline the management of their debt by dealing with a single loan servicer. This can simplify communication, reduce the chances of errors, and make it easier to access information about the loan.

Eligibility Criteria

To be eligible for student loan consolidation, borrowers must meet certain requirements set by the U.S. Department of Education. Consolidation allows borrowers to combine multiple federal student loans into one new loan with a single monthly payment.

Types of Loans Eligible for Consolidation

- Direct Subsidized Loans

- Direct Unsubsidized Loans

- Federal Perkins Loans

- Direct PLUS Loans

- FFEL Consolidation Loans

These are some of the common types of federal student loans that are eligible for consolidation. Private student loans are not eligible for federal consolidation, but they can be refinanced through private lenders.

Limitations or Restrictions for Consolidating Loans

- Consolidation is only available for federal student loans, not private loans.

- Borrowers must be in the grace period or repayment status to consolidate their loans.

- Consolidation may result in the loss of certain borrower benefits, such as interest rate discounts or loan forgiveness options.

- Once loans are consolidated, borrowers cannot un-consolidate them, so careful consideration is necessary before proceeding.

Consolidation Options

When it comes to consolidating student loans, there are various options available to students. It is essential to understand the differences between federal student loan consolidation programs and private student loan consolidation alternatives in order to make an informed decision.

Federal Student Loan Consolidation Programs

- Federal Direct Consolidation Loan: This program allows borrowers to combine multiple federal student loans into one new loan with a fixed interest rate.

- Income-Driven Repayment Plans: These plans are not traditional consolidation programs but can help lower monthly payments by adjusting them based on income and family size.

- Public Service Loan Forgiveness: For borrowers working in public service jobs, this program forgives the remaining balance on eligible federal student loans after making 120 qualifying payments.

Private Student Loan Consolidation Alternatives

- Private Lenders: Banks, credit unions, and online lenders offer private student loan consolidation, allowing borrowers to combine both federal and private student loans into one new loan with a potentially lower interest rate.

- Interest Rate Reductions: Some private lenders provide interest rate reductions for borrowers with a good credit score or a co-signer.

- Flexible Repayment Terms: Private consolidation options may offer more flexible repayment terms compared to federal programs.

Application Process

When applying for student loan consolidation, there are specific steps to follow to ensure a smooth and successful process. Here is a breakdown of the application process, along with tips on how to prepare and the documentation required.

Steps for Applying for Student Loan Consolidation

- Gather all your loan information: Before applying for consolidation, make sure you have all the necessary information about your current loans, including the types of loans, outstanding balances, and interest rates.

- Choose a consolidation option: Research different consolidation options and choose the one that best fits your needs, whether it’s through a federal direct consolidation loan or a private lender.

- Complete the application: Fill out the consolidation application form accurately and provide all the required information. This may include details about your income, expenses, and other financial information.

- Review and submit: Double-check all the information provided in the application form to ensure accuracy. Once you are satisfied, submit the application for processing.

- Wait for approval: After submitting your application, you will need to wait for approval from the consolidation lender. This process may take some time, so be patient.

Tips for Preparation

- Organize your loan information in advance to expedite the application process.

- Research different consolidation options to find the best fit for your financial situation.

- Ensure all your personal and financial information is up to date and accurate before filling out the application form.

- Communicate with your current loan servicers to understand any specific requirements or details needed for the consolidation process.

Documentation Required

- Proof of income: You may be required to provide pay stubs, tax returns, or other documents to verify your income.

- Loan statements: Gather your current loan statements to provide details about your existing loans, including outstanding balances and repayment terms.

- Identification documents: Have your driver’s license, social security number, and other identification documents ready for verification purposes.

- Any additional documentation: Depending on the lender and the consolidation option chosen, there may be additional documentation required. Be prepared to provide any requested information promptly.